The two richest people in New Zealand added an astounding NZ$1.1 billion to their fortunes in 2017-2018, while the wealth of the poorest half of the country decreased overall, according to new Oxfam research to be released today.

The report also reveals that the richest 5% of the population collectively owns more wealth than the bottom 90%.

Oxfam’s research forms part of a global report released to coincide with this week’s annual meeting of the wealthiest and most powerful people in the world, as they gather at the World Economic Forum in Davos, Switzerland. Prime Minister Jacinda Ardern is scheduled to attend the meeting, which focuses on global politics, economics and social issues.

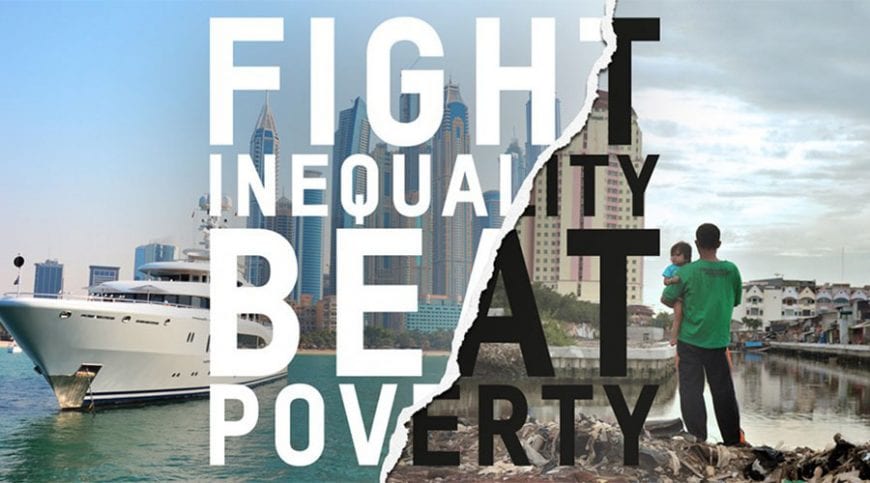

Published later today, the full report, Public Good or Private Wealth?, shows how the growing gap between rich and poor is undermining the fight against poverty, damaging local economies and fuelling public anger across the globe. The report reveals how governments are exacerbating inequality by, on the one hand, underfunding public services such as healthcare and education, while, on the other, under taxing corporations and the wealthy, and failing to clamp down on tax avoidance. The research also finds that consistently, women and girls are hardest hit by rising economic inequality.

Rachael Le Mesurier, executive director of Oxfam New Zealand, said: “We have a long way to go before we can say that every Kiwi is getting a fair go. We know inequality is harmful for us all. It perpetuates poverty, erodes trust, fuels crime, makes us unhappy, negates economic growth, and robs opportunity from the poorest – including shortening their lives. And women and girls suffer the most – across their lifetimes women have less opportunity than men to get paid work, they earn less and are less able to invest in assets.

“One of the key things we can do to tackle inequality here and across the world is to tax wealth more. Our taxes pay for schools, hospitals, and infrastructure such as communications and roads on which we all rely. Across the world, rich multinational corporations and extremely wealthy individuals are not paying their fair share. When big business and the super-rich don’t pay their fair share of tax, the rest of us pay the price – with kids without teachers, long waiting lists for health interventions, and not enough police in our communities.

“But to tax wealth more, we need to see it. We need more transparency in our tax system, both for multinational corporations and extremely wealthy individuals. We need more information in the public realm so that we can make sure that the wealthy pay their fair share – and that we grow a New Zealand where everyone gets a fair go in life.

“We are eagerly anticipating the release of the Tax Working Group’s final report early this year. As a country we’ve been talking about wealth taxes, such as capital gains, for some time now. To tackle the stubborn inequality that plagues ordinary, working Kiwis, we need to stop talking and start doing,” said Le Mesurier. “We hope the Tax Working Group takes this opportunity to recommend greater wealth taxes and more transparency, and we encourage the government to take the bold action necessary to reduce inequality”.

Notes to editors

- Oxfam’s calculations are based on the most up to date, comprehensive data sources available. Figures on the share of wealth owned by the poorest half of humanity come from Credit Suisse Wealth Databook and relate to the period June 2017 – June 2018. Figures on the very richest in society are based on more detailed data from the annual Forbes ‘Billionaires List’ and relates to the period March 2017 – March 2018.

- The two richest New Zealanders are Graeme Hart and Richard Chandler. They own wealth of US$10.1 billion and US$2.1 billion respectively. In 2016 Singapore-based Chandler was named as using Mossack Fonseca, the law firm at the centre of the Panama Papers tax avoidance controversy.

For more information or to arrange an interview please contact:

Kelsey-Rae Taylor | [email protected] | 021 298 5894