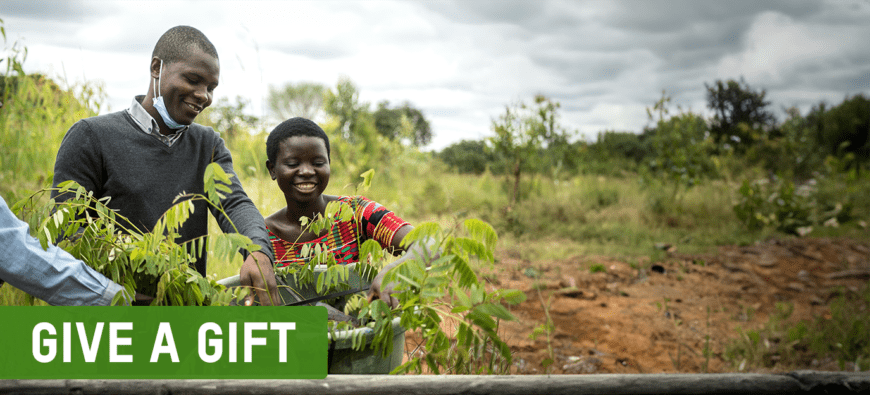

Disaster Response Fund

Together, we can save lives and help communities rebuild. Emergency funds are crucial for Oxfam to respond whenever disasters occur...

Can help provide life-saving hygiene kits to stop the spread of disease

Can help provide families with safe water for drinking and washing

Can help give families the tools, raw materials, and supplies they need to rebuild their homes, farms, and businesses